NEW TAX RATES FOR THE 2017-18 FBT YEAR

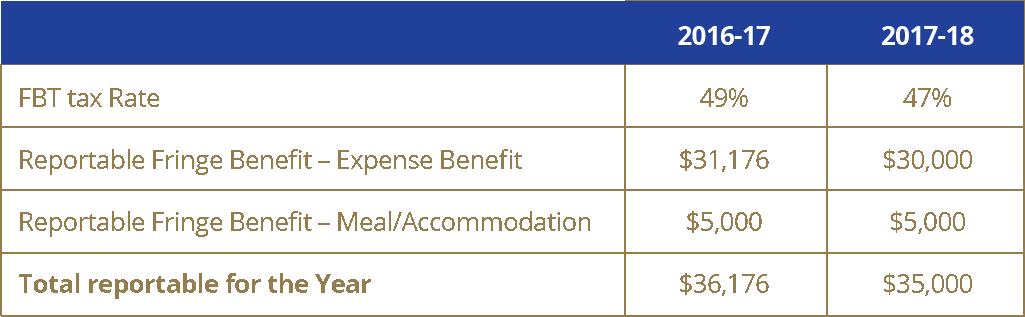

In line with the top marginal tax rate reducing from 49% to 47%, so does the Tax rate for the calculation of Fringe Benefits Tax.

What does this mean?

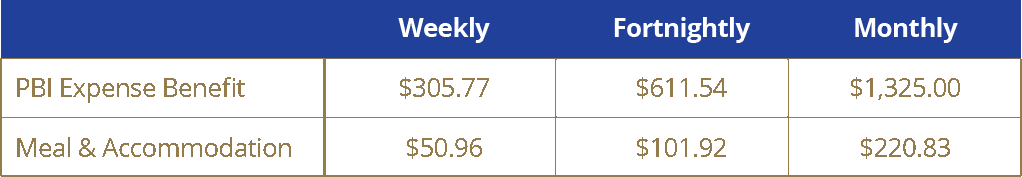

> Your Expense Payment Benefit remains at $15,899.94 per annum

> Your Meal and Accommodation benefit will increase by $100 per annum to $2,649.98!

Reportable Fringe Benefits – New for 2017/18

CALCULATING YOUR REPORTABLE FRINGE

BENEFITS FOR CENTRELINK

This applies to most calculations as they apply to:

– HECS/HELP

– Family Tax Benefits

– Child Care Benefits

If an employee is taking advantage of both the:

– $15,899.94 PBI Benefit and;

– $2,649 Meal & Accommodation Benefit

Their Reportable Fringe Benefit for the 2016-17 financial year will be $36,176

$36,176 x 51% = $18,449.76 this will be the figure used for income/benefit calculations.

Their Reportable Fringe Benefit for the 2017-18 financial year will be $35,000

$35,000 x 51% = $17,850.00 will be the figure used for income/benefit calculations.

Everyone’s circumstances are different so we strongly recommend that you seek your own advice and calculations on the MyGov website. These calculations DO NOT apply to Child Maintenance Payments. Again, you are urged to seek additional advice on the impact of these payments on your obligations.

Timothy Vlug (Author)

View Post