NEW TAX RATES FOR THE 2017-18 FBT YEAR

In line with the top marginal tax rate reducing from 49% to 47%, so does the Tax rate for the calculation of Fringe Benefits Tax.

What does this mean?

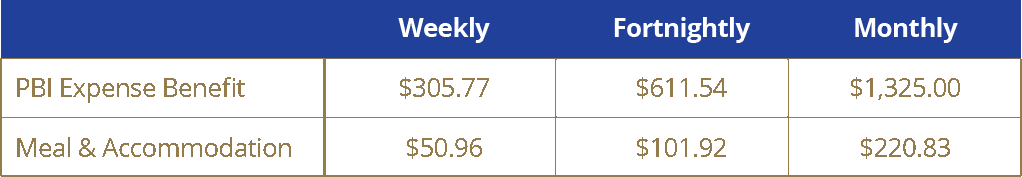

> Your Expense Payment Benefit remains at $15,899.94 per annum

> Your Meal and Accommodation benefit will increase by $100 per annum to $2,649.98!

Reportable Fringe Benefits – New for 2017/18

CALCULATING YOUR REPORTABLE FRINGE

BENEFITS FOR CENTRELINK

This applies to most calculations as they apply to:

– HECS/HELP

– Family Tax Benefits

– Child Care Benefits

If an employee is taking advantage of both the:

– $15,899.94 PBI Benefit and;

– $2,649 Meal & Accommodation Benefit

Their Reportable Fringe Benefit for the 2016-17 financial year will be $36,176

$36,176 x 51% = $18,449.76 this will be the figure used for income/benefit calculations.

Their Reportable Fringe Benefit for the 2017-18 financial year will be $35,000

$35,000 x 51% = $17,850.00 will be the figure used for income/benefit calculations.

Salary Packaging changes come into effect 1 April 2016. Are you ready?

A number of salary packaging changes announced in last years’ Federal Budget will become effective from 1 April 2016. These changes impact the following benefits:

- Salary packaging of meal entertainment (dining)

- Holiday accommodation (‘venue hire’) claims.

To ensure you understand the implications of these important changes, we’ve prepared a summary of the changes and their impacts.

What’s changing?

From 1 April 2016, Meal Entertainment (Dining) and Holiday Accommodation (‘Venue Hire’) expenses will effectively become a single benefit.

Read More

Salary packaging as a business tool: Debunking the myths

Instead of just complying with the fringe benefits tax legislation, why not use it to your advantage? Salary packaging can maximise take-home pay and attract talent.

Could salary packaging be a cost-effective way to attract and retain talent?

By combining cash salary with other benefits, organisations have greater flexibility to negotiate remuneration , but that’s just one of the advantages of salary packaging. Many people don’t know that the strategy can also be used to obtain tax benefits. As a whole, the fringe benefits tax (FBT) provides a legal framework that companies can use to manage costs and talent, building a strategic platform for recruitment and retention.

The first step to effective salary packaging is understanding how some simple FBT strategies can benefit businesses. Here are five of the most common myths that could be holding companies back from attaining these rewards.

Did you know that employees can salary package FIFO costs?

The recent John Holland v ATO case surrounding the deductibility to Fly-In-Fly-Out costs has put the whole FIFO sector back in the headlines. With the ruling overturned, it’s highlighted how companies can benefit when applying the Fringe Benefit Tax (FBT) rules properly and in a compliant way.

While this decision, and subsequent successful High Court appeal, does not affect the majority of FIFO arrangements, this case has highlighted a number of rules that need to be adhered to when providing these benefits to your employees.

The place of work must be designated as Remote as per s140. Interestingly, this was a major argument in the ATO’s case against John Holland, that Geraldton WA is an Eligible Urban Area and as such is Non-Remote

The employee’s work roster must be variable or rotating. Not simply fly-in Monday and fly-out on Friday.

A full list of remote and non-remote towns appears on the ATO website.

Do you know that your employees can salary package FIFO costs?