NEW TAX RATES FOR THE 2017-18 FBT YEAR

In line with the top marginal tax rate reducing from 49% to 47%, so does the Tax rate for the calculation of Fringe Benefits Tax.

What does this mean?

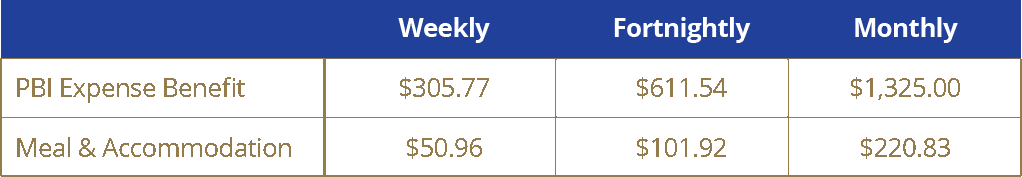

> Your Expense Payment Benefit remains at $15,899.94 per annum

> Your Meal and Accommodation benefit will increase by $100 per annum to $2,649.98!

Reportable Fringe Benefits – New for 2017/18

CALCULATING YOUR REPORTABLE FRINGE

BENEFITS FOR CENTRELINK

This applies to most calculations as they apply to:

– HECS/HELP

– Family Tax Benefits

– Child Care Benefits

If an employee is taking advantage of both the:

– $15,899.94 PBI Benefit and;

– $2,649 Meal & Accommodation Benefit

Their Reportable Fringe Benefit for the 2016-17 financial year will be $36,176

$36,176 x 51% = $18,449.76 this will be the figure used for income/benefit calculations.

Their Reportable Fringe Benefit for the 2017-18 financial year will be $35,000

$35,000 x 51% = $17,850.00 will be the figure used for income/benefit calculations.

Salary Packaging changes come into effect 1 April 2016. Are you ready?

A number of salary packaging changes announced in last years’ Federal Budget will become effective from 1 April 2016. These changes impact the following benefits:

- Salary packaging of meal entertainment (dining)

- Holiday accommodation (‘venue hire’) claims.

To ensure you understand the implications of these important changes, we’ve prepared a summary of the changes and their impacts.

What’s changing?

From 1 April 2016, Meal Entertainment (Dining) and Holiday Accommodation (‘Venue Hire’) expenses will effectively become a single benefit.

Read More