IS YOUR COMPANY VEHICLE POLICY FRAUGHT WITH DANGER?

Are you reviewing your Company Motor Vehicle Policy with a view to cutting costs and creating efficiency?

While this is a very important and much needed review, we are not seeing much science being applied to the solutions being proposed.

In the not-for-profit sector in particular, we are seeing a growing propensity to ask employees to use their own private vehicles in the discharge of their duties.

The policy of “Bring Your Own Device” (BYOD) is increasingly prevalent in our schools and work-places. While this policy works for computers, laptops, mobile phones and other electronic devices, applying it to motor vehicles is another issue entirely.

For many roles, the move from a traditional Company provided vehicle to a Vehicle Cash Allowance and Novated Lease arrangements is highly desirable and indeed, good policy for both the Employer and Employee.

However, asking employees to use their own car as a Job Facility vehicle is at best inappropriate and at worst, fraught with danger.

Things to consider

How Trinitas will help!

Our fleet review process focusses on delivering cost savings through greater efficiency in procurement, financing and overall management of your fleet, thereby allowing your employees and available financial resources to be used far more efficiently in delivering your services to your clients

- Review the requirements of your fleet;

- Conduct “fit-for-purpose’ modelling to acquire the most appropriate, modern and safe vehicles;

- Categorise your fleet separating Private Use vehicles from Job Facility vehicles

- Ensure compliance with Fringe Benefits Tax legislation

- Implement strategies for the future procurement, financing and management of the fleet.

Contact Tim for a FREE Fleet Review

CONTACT TIM

HUMAN CAPITAL:

ATTRACT AND RETAIN THE BEST FOR LESS

Effective salary packaging delivers an improved post-tax remuneration for your employees – reduces employer’s costs and ensured 100% compliance.

The spirit of the Fringe Benefits Tax Legislation (FBTAA, 1986) is to provide employers with a legal framework to attract and maintain quality employees with a greater range of tax effective benefits while not increasing payroll costs.

What we do

- Create a customised salary packaging program

to meet the needs of your business. - Fully integrated end-to-end processing

through finance and payroll systems and Trinitas Bureau Administration ensuring efficiency and accuracy. - Ongoing Employee Engagement

including education and advice via handbooks, presentations and materials; - Management of all Employee enquiries

to minimise the impact on the employer and ensure accurate advice; - Compliance Management:

Maintain all documentation and records ensuring 100% compliance. - Corporate advisory services

in reviewing FBT and salary packaging arrangements.

We can help you

- Efficiency in management of Fringe Benefits Tax

- Reduction in Payroll tax and WorkCover Premiums

- Reduction on Re-Employment Costs due to reduced turnover

- Greater tools for the attraction and retention of quality and valued employees

- Become an Employer of choice within your industry

We help your employees

- Effective salary packaging leads to Income tax savings and greater remuneration!

- Ability to maximise remuneration at the point of being paid – no administration at tax time!

- Potential for increases in Centrelink benefits: Family Tax Benefits, Child Care Benefits and more..

- Foster greater loyalty and motivation to the employer

Trinitas Salary Packaging and Fleet Management

Tailored Strategy

Sustained Employee Engagement

Full Service Compliance

The Trinitas Difference

Trinitas is an FBT strategy, salary packaging and fleet management firm, differentiated by its advice-driven approach and full-service offering. Trinitas’ approach ensures employers and employees are provided with a tailored strategy, backed-up by a quality administration bureau service that ensures compliance with all relevant legislation.

- Delivers tailored strategy to employer and employee

- Provides customised advice to employee

- Committed to sustained employee engagement

Trinitas’ differentiator to FBT consultants

- Committed to sustained employee engagement

- Focused on maximising employee participation

- Provides full admin bureau service

As an independent operator, Trinitas is not conflicted in the advice it provides.

Trinitas’ Track Record

With a 16-year history, Trinitas is a leading privately-held full-service FBT strategy, salary packaging and fleet management provider.

Over the past 3 years, Trinitas has enjoyed 96% compound annual growth in the number of employees it services. Trinitas has a national client base including more than 30 corporate clients across a diverse range of industries including both the private and NFP sectors.

A Full Service Offering

Trinitas delivers the following end-to-end packaging services:

Employer Strategy

- Trinitas undertakes a Discovery Phase to understand the employer’s business and its specific staffing objectives including budgetary constraints, attraction and retention considerations thereby enabling a strategy to be tailored to the employer’s specific objectives.

- Trinitas conducts a Strategic Review of all current FBT management and employee benefit practices including industry insight as to current best-practices.

- Trinitas assists the employer to refine its internal policies and assists with the implementation.

Employee Engagement

- Trinitas is committed to educating employees on the benefits of packaging and delivers face to face presentations, an employee handbook, newsletters and regular updates.

- Employees are provided access via both group and one-on-one meetings with Trinitas’ packaging consultants to ensure the employee receives tailored advice specific to their circumstances.

- As effective packaging can be a strategic tool for the employer, core to Trinitas’ service is its sustained employee engagement to maximise participation and the benefit provided to employees.

Bureau and Compliance

- Trinitas’ administration processes are “KPI-led” providing employers with regular evidence of processing compliance on an ongoing basis.

- Trinitas’ efficient and secure FBT administration and payment system has been custom-designed to remove the roadblocks to salary packaging administration and ease the burden on the employer’s payroll function.

- Trinitas’ bureau software integrates seamlessly with the employer’s internal payroll and finance systems.

Tangible Benefits to Employers and their Employees

Trinitas is focussed on delivering tangible outcomes to its clients and their employees:

Employers

- Tailored strategies to deliver cost savings in salaries and on-costs

- Positioning as an “employer of choice”, attracting employees through market-competitive packages

- Streamlined FBT and motor vehicle processes that are 100% compliant

Rigorous employee engagement processes that maximise participation

- Improved after-tax financial position

- Tailored advice to suit the individual’s requirements

- Streamlined application, implementation and ongoing administration

- Leveraged buying power to deliver better pricing

One-stop-shop for the employee’s packaging advice and processing

Trinitas – Partnering with Accountants and Planners

With over 90% of business generated from referrals, Trinitas is focussed on preserving and enhancing the relationship between referrers and their clients.

As such, Trinitas’ service is complementary to that offered by the employee’s accountant and/or financial planner. For example, Trinitas manages the administration bureau and provides full regulatory and management reporting to assist accountants and advisers in the preparation of FBT year-end administration.

Salary packaging is considered one of the purest forms of financial planning as it maximises income at the point of being paid. All tax and/or financial planning opportunities emanating from salary packaging consultations are referred directly back to the client’s adviser. Trinitas’ service delivers tangible benefits to the employee and as such can be used by accountants and planners as a value-added offering that further differentiates their business.

CONTACT US

NEW TAX RATES FOR THE 2017-18 FBT YEAR

In line with the top marginal tax rate reducing from 49% to 47%, so does the Tax rate for the calculation of Fringe Benefits Tax.

What does this mean?

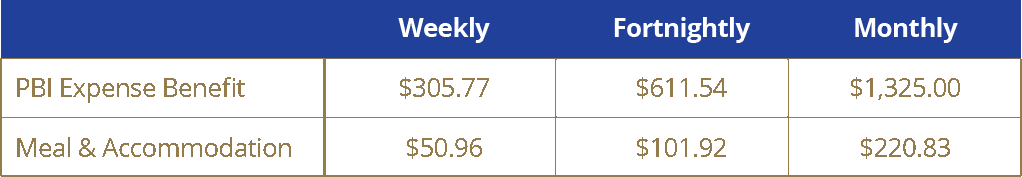

> Your Expense Payment Benefit remains at $15,899.94 per annum

> Your Meal and Accommodation benefit will increase by $100 per annum to $2,649.98!

Reportable Fringe Benefits – New for 2017/18

CALCULATING YOUR REPORTABLE FRINGE

BENEFITS FOR CENTRELINK

This applies to most calculations as they apply to:

– HECS/HELP

– Family Tax Benefits

– Child Care Benefits

If an employee is taking advantage of both the:

– $15,899.94 PBI Benefit and;

– $2,649 Meal & Accommodation Benefit

Their Reportable Fringe Benefit for the 2016-17 financial year will be $36,176

$36,176 x 51% = $18,449.76 this will be the figure used for income/benefit calculations.

Their Reportable Fringe Benefit for the 2017-18 financial year will be $35,000

$35,000 x 51% = $17,850.00 will be the figure used for income/benefit calculations.

Salary Packaging changes come into effect 1 April 2016. Are you ready?

A number of salary packaging changes announced in last years’ Federal Budget will become effective from 1 April 2016. These changes impact the following benefits:

- Salary packaging of meal entertainment (dining)

- Holiday accommodation (‘venue hire’) claims.

To ensure you understand the implications of these important changes, we’ve prepared a summary of the changes and their impacts.

What’s changing?

From 1 April 2016, Meal Entertainment (Dining) and Holiday Accommodation (‘Venue Hire’) expenses will effectively become a single benefit.

Read More